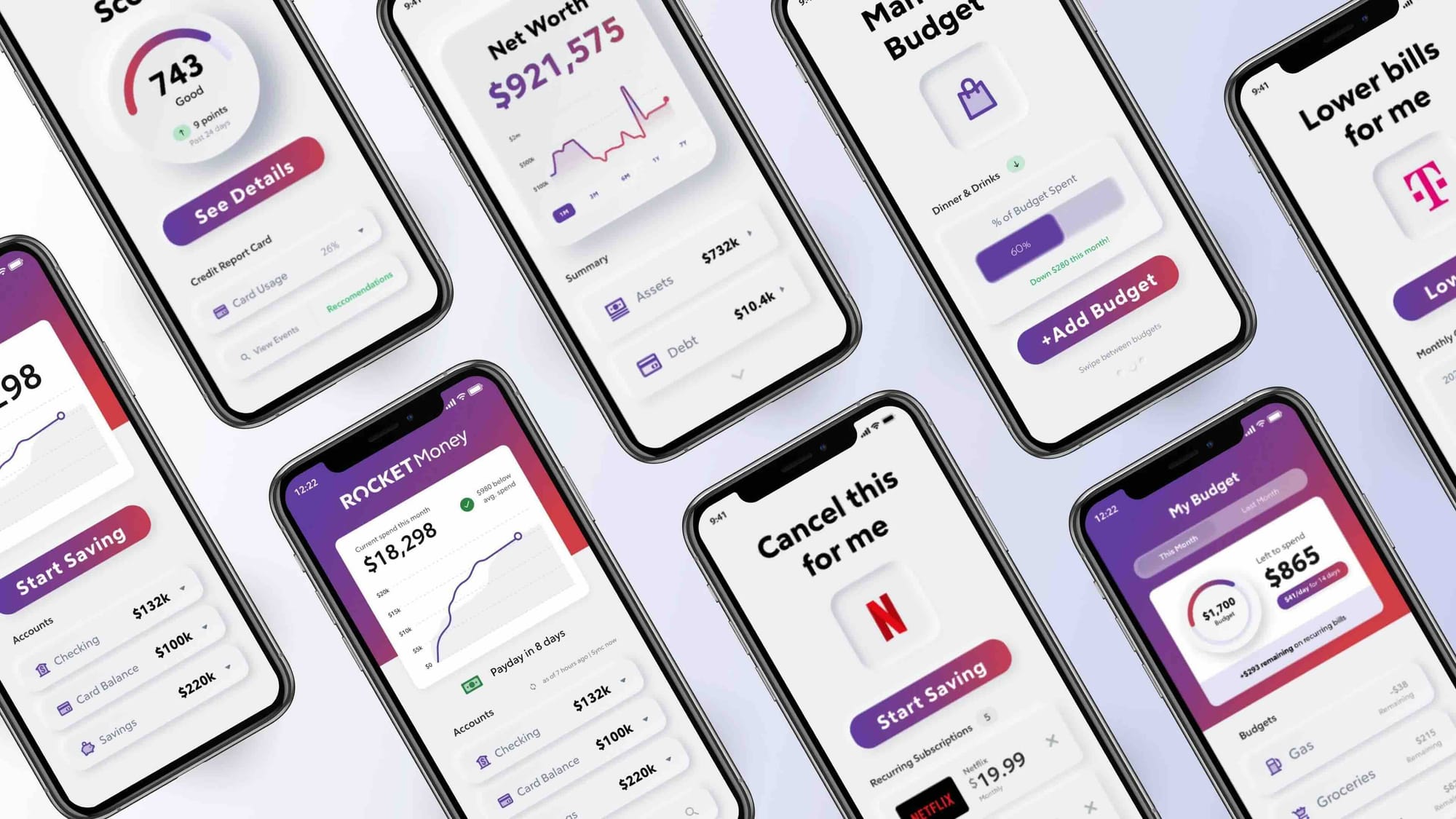

Rocket Money – 2024 Review: 15 Ways to Supercharge Your Finances

Money management is a necessary thing at a high pace in today's world of finance. This is where Rocket Money comes in; it finally migrated to become one of the best-reputed budgeting apps in the U.S.A., with a promise to revolutionize your financial life. But does it really live up to the hype? In our review below, we dig deep to reveal 15 ways that Rocket Money can change your financial life in 2024.

Key Takeaways

Rocket Money, formerly Truebill, is a budgeting and savings app with over 5 million members. Here's what you should know:

- It has both free and premium versions available. The cost of the premium options is $4-$12 per month.

- Subscription management is where this app really excels—it can save you hundreds of dollars every year.

- In addition, Rocket Money has strong tools for budgeting, automated savings, and services like bill negotiation.

- Key features include credit score monitoring, tracking your net worth, and customizable spending categories.

- It has bank-level security for keeping your financial data secure.

Whether you want to eliminate some expenses that are not necessary, save more money, or make better-informed choices about money, Rocket Money has the tools you need.

Rocket Money Overview: Your Personal Finance Powerhouse

Rocket Money, acquired by Rocket Companies in 2021, is a trusted budgeting tool that offers a variety of money management features. It's designed to help you take control of your financial life.

🚀 Key Highlights:

- Type of Personal Budget: Traditional budget

- Best For: Managing subscriptions and overall financial health

- Cost: Free version available; Premium version $4-$12/month

- Free Trial: Yes, 7-day free trial

- Links to Accounts: Yes; Bank, investment, and credit card accounts

- Apple App Store Rating: 4.2/5

- Google Play Rating: 4.3/5

Since its founding, Rocket Money has helped customers save more than $500 million. How? By canceling unwanted subscriptions and providing smart saving solutions.

What is Rocket Money?

Rocket Money is an app for self-finances, which helps the user make spendings easy and keep subscribed to the tools they need. It has the feature that lets users easily locate subscriptions for easy cancellation, manage bills, and monitor accounts.

Key Features

-

Subscription Management: It can cancel any unwanted subscription with a single click, thus saving the user from unnecessary expenses.

-

Budgeting Tools: The app contains budgeting capacity where users can set their financial goal and progress can be monitored.

-

Transaction Tracking: Rocket Money automatically downloads user transactions, categorizes them, and highlights the ones that are in line with cash plans to make it easier for the user to manage finances.

-

Premium Version: The app is free of cost for download, but most of the advanced features are in its subscription; it operates on a pay-what-you-wish model and typically suggests $10 per month. Enhanced budgeting tools, a feature that helps in canceling subscriptions, and access to credit scores are some of the premium services provided.

Security

Rocket Money secures its users' data with bank-level encryption, which means personal banking information is never on their servers.

Overall, Rocket Money is branded as an all-in-one personal finance management tool, but it works best for those who are looking for simplified subscription and budgeting solutions. Unfortunately, the best features come at a price since the paywall means the premium version of this app is required for full functionality.

Citations:

[1] https://www.rocketmoney.com

[2] https://www.cnet.com/personal-finance/banking/reviews/rocket-money-review/

[3] https://play.google.com/store/apps/details?hl=en_US&id=com.truebill

[4] https://www.pcmag.com/reviews/rocket-money

[5] https://play.google.com/store/apps/dev?hl=en_US&id=7632167371822365916

15 Ways Rocket Money Can Supercharge Your Finances

1. Subscription Management: Tame the Subscription Beast

One of the best features of Rocket Money is that it can help you monitor and manage your subscriptions. Why does this come in handy? Because in today's world, it's very easy to start piling up those subscriptions without even noticing.

The app automatically detects and sorts your recurring payments. This helps you catch and cancel unnecessary subscriptions, which could save you hundreds of dollars a year.

2. Bill Negotiation: Let the Experts Deal with It

Have you ever tried negotiating your bills? It can be a hassle. Rocket Money's bill negotiation service is a game-changer.

The app can get out there and negotiate your bills with service providers. Even if the bill-slashers take their cut, generally set at 30%-60% of the estimated first-year savings, in many cases, this can still add up to big money saved on phone, cable, and internet bills.

3. Automated Savings: Wealth Building Made Easy

Where setting savings goals is one thing, saving consistently is another. Rocket Money's Smart Saving feature does the heavy lifting for you.

How does it work? The app scans how you've been spending money and then automatically transfers it over to your savings account. It's more convenient than ever to grow your financial buffer because you don't have to remember to do this each and every day.

4. Comprehensive Budgeting Tools: Take Control of Your Spending

Do you know where your money goes each month? Rocket Money has very rich budgeting features that let you create customized budget categories and follow your outflow across many types of expenses.

This feature is designed to give you better visibility over your financial habits, eventually helping you make better decisions regarding your money.

5. Monitoring Your Credit Score: Keep an Eye on the Health of Your Credit

Rocket Money: Your credit score has a major impact on everything that happens in your life; this will keep an eye on it via its credit monitoring service.

The app gives access to a user's credit report and important change alerts, which, over time, shall make the user maintain and achieve better health with their credit score.

6. Track Net Worth: Look at the Whole Picture

What's your net worth? Rocket Money can calculate and track by aggregating data from your financial accounts that are linked.

It provides a high-level overview of your financial health and enables you to set and attain your long-term financial goals.

7. Bill Reminders: Never Miss a Payment Again

Late payments have disastrous repercussions for your credit and finances. Luckily, with Rocket Money's bill reminder feature, you are all set.

The app sends notifications regarding the due date that is incoming to help you avoid those unnecessary late fees and maintain a good record.

8. Income Tracking: Know Your Cash Flows

Know where your money comes from—accomplished. Knowing its source is the whole point of being aware of your income so that you can budget. Rocket Money helps monitor all sources of income to maintain a really clear view of your cash flow.

This feature is very handy for freelancers and people with several income streams.

9. Understanding your money habits: Insights into spending

Do you know your spending patterns? Rocket Money will provide detailed analytics for valuable insight into your financial habits.

The app categorizes your transactions but can also go ahead and break your spending habits visually so you are able to see where you are overspending in order to cut back.

10. Custom Categories: Personalize Your Budget to Fit Your Life

Everybody's financial situation is different. Rocket Money allows you to set spending categories that are relevant to your lifestyle.

This flexibility allows you to budget better and take account of your most important expenses.

11. Goal Setting: Chart Your Financial Future

What are your financial goals? Whether it be saving up for that holiday, making a down payment on a house, or putting together an emergency fund, Rocket Money helps to establish and track those.

The app encourages and keeps you on track with your spending, making it easier for you to realize financial success.

12. Bank-Level Security: Your Data—Safe

In this day and age where cyber threats continue to rise, data security sits at the heart of it all. Rocket Money deeply cares about your security, which is why we use bank-grade encryption for your financial data.

You can be assured that your sensitive information is secure.

13. Multi-Platform Accessibility: Control your Money from Anywhere

In today's mobile world, multi-platform accessibility is very crucial. As Rocket Money avails multiple platforms, you will never miss a chance to check and manage your finances anywhere, at any given time.

You have full control of your money by using Rocket Money across iOS, Android, and a web-based interface.

14. Premium Features: Access Advanced Tools

The free version of Rocket Money offers general use, while the premium version unlocks a comprehensive range of advanced features.

They are: Real-time syncing for accounts, Unlimited budgets, Premium chat support. These tools give you a more encompassing experience if indeed you're serious about your finance game.

15. Learning Resources: Increase Your Financial Literacy

Power does come with knowledge and, moreover, with money. Rocket Money supplies you with educational content to improve your financial literacy.

Gain insight into the ways you should make appropriate decisions about your money—from blog posts to in-app tips.

Why We Like Rocket Money

Rocket Money is an embodiment of one difference, at least within the world of budgeting apps and personal finance management. Here's why we think it's such a valuable tool:

- Holistic Financial View: You can connect all your financial accounts to Rocket Money and keep your complete financial life in one place.

- Proactive Savings: Automatic savings service and bill negotiation constantly work to save you money.

- User-Friendly Interface: The user interface design is very much intuitive and hence friendly to users of all financial backgrounds in terms of navigating and using the features of the app.

- Personalized Experience: Rocket Money allows you to make the app your own, from budget categories to saving goals.

- Continuous Improvement: Regular updates and new features speak volumes about the company's intent to provide a better user experience and to be more adaptive to changes in the financial landscapes.

Is Rocket Money Worth It?

After having made a profound analysis and comparison with other personal finance applications, we conclude that Rocket Money offers good value for most users. The free version offers a good toolkit for basic budgeting and subscription management.

The premium version unlocks a suite of powerful tools that could potentially save you hundreds or thousands of dollars every year. But the value you take from Rocket Money is mostly dependent on your financial situation and how actively you interact with the app.

If you have a hard time managing subscriptions, negotiating bills, or just keeping a budget on track, Rocket Money could be a game-changer in your financial situation.

Conclusion: Empower Your Financial Journey

In conclusion, Rocket Money is an amazing personal finance app that will provide you with a suite of tools to have control over your money. From fighting off those unwanted subscriptions to giving you invaluable spending insight, Rocket Money keeps the tools at your fingertips that you need to make the most sound financial decisions.

While not the be-all and end-all solution, its combination of features is unique, with a friendly user interface and potential savings that put it in good stead in the personal finance apps segment. We encourage everyone to use the free trial and see how Rocket Money fits their financial goals and management style.

After all, with any financial tool, it is how you use it that matters. Rocket Money helps provide the structure, but your commitment to financial health and smart decision making is what will drive your success in the end. Grab hold of your financial life today and see how Rocket Money can help you blast off toward your financial goals!

FAQs

Is the Rocket Money app worthwhile?

It can really be worth it for many users of Rocket Money, particularly those who are looking to manage their subscriptions, negotiate on bills, and get insight into their finances. The free version has important features, but the premium version has more complete tools for serious financial management.

What is the difference between paid and free Rocket Money?

In the free version of Rocket Money, there are basic budgeting and subscription tracking features. The other features of the paid version include real-time syncing of accounts, unlimited number of budgets, premium chat support, and more frequent updates on the credit score, all in one go for the full financial management experience.

Which app is better: Mint or Rocket Money?

Both Mint and Rocket Money are both great apps when it comes to budgeting, but they excel at different things. Rocket Money really shines with its subscription management features and bill negotiation. Now, Mint is a much better app for investment tracking. It all depends on which part of your financial life takes priority.

What is Rocket Money charging to reduce bills?

Rocket Money charges 30-60% of the estimated first-year savings as a result of a successful negotiation of a lower bill. While this might sound a lot, you pay Rocket Money if—and only if—you get savings in your pocket.

How does subscription tracking work with Rocket Money?

The subscription tracking feature of Rocket Money will automatically detect your reoccurring charges in linked accounts. It categorizes your subscriptions and allows you to pinpoint and cancel any unwanted services, possibly saving hundreds of dollars a year on subscriptions you have forgotten about or no longer need.