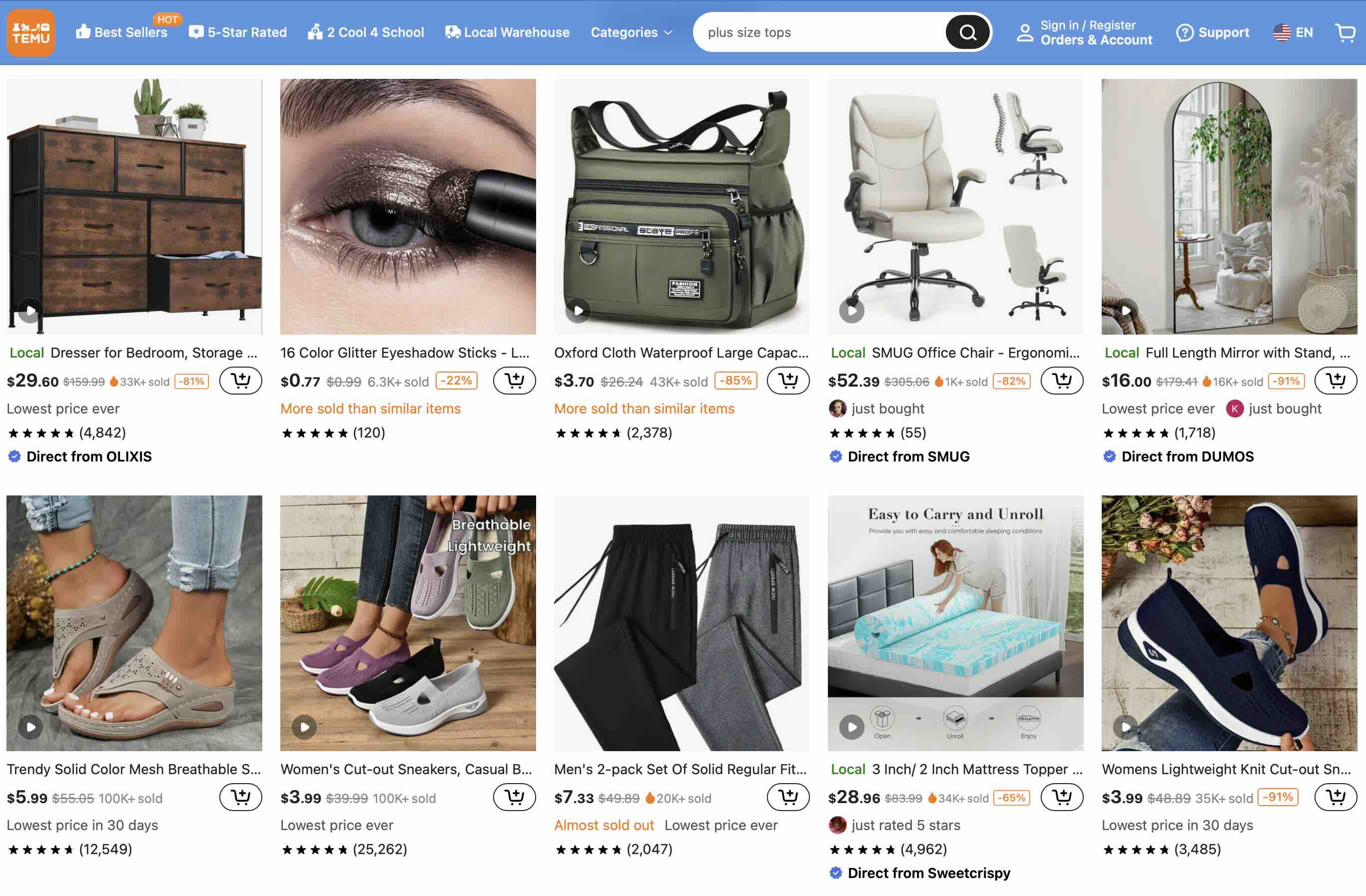

Temu: Pushing Low-Quality Products Through Influencer Marketing

Temu really exploded onto the e-commerce scene in 2022, producing much attention from its rock-bottom prices on a vast array of items. However, even savvy shoppers started to dig deeper than these great deals and pose other questions about the real nature of this company and its products.

Temu Founder

It was modeled after PDD Holdings, the very same Chinese conglomerate behind budget shopping app Pinduoduo. To that end, Temu appears to be drawing from a very similar playbook: rapid growth and market share at all costs, if not product quality or brand sustainability.

Its business model is based on ultra-low-cost goods directly sourced from manufacturers in China and sold at slim margins. While this enables basket-clearing prices, it often does at the expense of quality control, conditions for workers, and standards for the environment.

Temu Marketing Strategy & Practices

In an effort to quickly embed brand awareness and drive sales, Temu has fallen to an aggressive influencer marketing strategy—what some have referred to as "influencer farming." It reportedly inundates social media with sponsored content by engaging hundreds of micro and nano influencers in a never-ending buzz around their products.

Due to the incentive most influencers get, it really doesn't matter what kind of items they get for review purposes; to this end, one sees many unboxing videos and positive reviews. The volume misguides through the creation of an illusion of popularity and reliability not actually existent in reality.

Scores of reports are given by consumers who were lured by the fantastic deals, and who experienced problems with the quality of the product, shipping times, and customer service. Most items turned out to be really inexpensive copies of brand-name products—flimsy and sometimes barely useful.

Although the prices of Temu are extremely low, shoppers must be very cautious. After all, a good number of the time, it is literally true: you get what you pay for. Do your research on product reviews not sponsored by that particular brand and consider the long-term value and impact of ultra-cheap, disposable goods before making a purchase.

It's the practices that Temu will have, along with the broader implications of its business model, that consumers and regulators should keep a close eye on as it continues in its quest for dominance.

Temu: The Tycoon Behind the Curtain

While millions of dollars have been invested in Temu's meteoric rise, very few have gone to its actual powerhouse. Dhanin Chearavanont is a Thai-Chinese billionaire at the center of PDD Holdings, Temu's parent company. Chearavanont also holds the position of senior chairman in Charoen Pokphand Group, better known as CP Group—an enormous conglomerate with interests in agriculture, telecommunications, and retail.

CP Group is the master franchise of 7-Eleven in Thailand; it has more than 12,000 stores nationwide. Conversely, this large retail network incubated an enormous influence for Chearavanont in Southeastern Asian markets.

Some observers have voiced concerns over how close Chearavanont is to China and how this could influence Temu's activities and broader strategic ambitions. One of the most influential Thai-Chinese businessmen, Chearavanont, has been one of the loudest policymax voices supporting stronger economic ties between Thailand and China.

In the long term, critics argue that Temu will be a means for spreading Chinese economic influence across the world, especially in Western markets. Flooding these markets with low-priced goods 'made in China,' Temu advances geopolitical and economic goals besides merely making a profit.

The relentless expansion and willingness to operate on thin margins have led some to speculate whether this might be underpinned by state support or alignment with official Chinese programs such as the Belt and Road.

Such connections are still speculative, however, they do illustrate the complex web of business and political interests that may underpin even the most seemingly straightforward of e-commerce platforms. And as the platform continues to gain growth, Temu's ownership structure and potential geopolitical implication is likely to face much sharper scrutiny.

It is important to make consumers realize that their purchasing decisions, especially on platforms like Temu, can affect much more than getting a good deal. Ultra-cheap goods often come with a cost that far transcends what is reflected on the price tag: local businesses, labor practices, and even international relations.

Temu Expansion in Thailand

Temu's expansion into Thailand and how they have approached the Southeast Asian market. Let me summarize and analyze the key points:

1. Expansion Timeline

- Temu went live in Thailand on July 29, 2024

- It had earlier entered Malaysia and the Philippines

- By July 2024, Temu operates in over 70 countries worldwide.

2. Global Performance

- Temu's global GMV achieved USD 20 billion in the first half of 2024

- Which was more than it had achieved in a full year in 2023, marking quick growth

3. Southeast Asia Strategy

- Temu is also adopting a cautious approach in Southeast Asia

- Q4 FY22 result: GMV of Temu in Southeast Asia was less than USD 100 mn in 2023—Much smaller than TikTok Shop and other peers.

4. Market Challenges

- Intense competition from established operators such as Shopee, Lazada, and TikTok Shop

- Insufficient competitive advantage in price due to late entry

- There are different levels of economic development and logistics infrastructure amongst the countries in Southeast Asia.

5. Market Entry into Thailand

- Discounted up to 90% for a grand opening

- Focuses on cross-border goods with global reviews and ratings.

6. E-commerce Landscape of Thailand

- The second biggest e-commerce market after Indonesia in Southeast Asia.

- a year-on-year growth of 34.1%

- It was dominated by Shopee at 49 percent, Lazada taking 30 percent, and TikTok Shop at 2113 percent in 2023.

7. Problems in Logistics

- Created a multiple-location shipment order-fulfillment system

- Aims for shipment in under five days from Guangzhou to Bangkok.

- More time-consuming due to fragmented address systems, different road planning, and transport vehicles in order in some countries

8. Payment Issues

- Not paying on time An international credit card and PayPal are the center of the service.

- Southeast Asia has lower credit card penetration rates

- There's more usage of cash on delivery across the region

9. Market Strategy

- Low prices are not as effective in Southeast Asia as they were in the case of China and the West.

- High sensitivity to price due to inflation and economic conditions

For Temu, entering Thailand is a bold but cautious step into Southeast Asia. It has to confront formidable local competitors, logistical complexities, and payment-preference issues that are quite different from those in its core markets.

In Southeast Asia, where the market for prices is relatively low, Temu would not be so differentiated from the current market, so it will have to adapt its strategy, probably with a unique selling proposition on products and services that add peripheral value and optimize logistics efficiency with additional payments in order to win a corner in this highly competitive market.

Temu must, however, be feeling its way around much of fast-growing Southeast Asia, with its performance slowing down compared to conditions worldwide. Its future success within the region and further expansion within Southeast Asia will most likely rely on the way its services can be most appropriately tailored to local needs and the overcoming of the unique challenges facing the region.

Temu Disadvantages

In opposition to Temu's business model, here is a list of probable disadvantages:

- Late entrance into the market: Temu is a late entrant into the Southeast Asian e-commerce marketplace, where players have already captured substantial market share.

- Slim price edge: Temu does not have magnificent price advantages over incumbent platforms in Southeast Asia compared with that elsewhere.

- Logistics challenges: The diversity of geography and infrastructure in Southeast Asia makes the region an increasingly demanding market in terms of effective delivery.

- Payment method limitations: Temu, relying on international credit cards and PayPal, may not serve well in a region where cash on delivery remains a preferred way of paying.

- Less Known Brand: Absolutely new to the game, Temu doesn't show as much familiarity with the brand for the local consumer compared to platforms like Shopee or Lazada.

- Cross-border focus: With the reliance on cross-border goods, delivery times may be longer in comparison with locally stocked items.

- Potential quality concerns: It is a low-price ultra-model; therefore, concern arises as to the quality of the different products that Temu will offer.

- Geographical localization: Temu would have difficulty adapting to specific cultural preferences and shopping habits of the countries in Southeast Asia.

- Low market share: The existing GMV in Southeast Asia is way lower as compared to rivals, thus showing the small existence within the marketplace.

- Regulatory challenges: Temu needs to contend with the different e-commerce regulations within each Southeast Asian country.

- Customer service issues: Customer support may become challenging across languages and cultures.

- Counterfeit products risk: The model of the platform, sourcing low-cost goods directly from the manufacturer, increases the risks related to counterfeit products.

- Environmental: This orientation towards low-cost, potentially disposable goods will be open for criticism on sustainability grounds.

- Influencer saturation: Influencer marketing is used so much that it can cause customer fatigue or skepticism.

- Data privacy concerns: Since Temu is an organization owned by China, there might be strict control over data handling in a few markets.

Conclusion

Temu's aggressive expansion into Thailand no doubt makes for a defining moment within the Southeast Asian e-commerce landscape. Success, however, is far from a fact. With dominant giants ruling the market and logistic nightmares, not to mention a business model treading that thin line between affordability and quality, prospects are pretty easy for Temu as things stand.

Counterfeit goods loom large over potential customer trust and legal repercussions alike. As Temu seeks to reproduce the same amount of success it has seen in the West in this complex and fiercely competitive region, minefields of challenges could make or break its ambitions.

The next few months will determine whether the cautiousness behind Temu and its ultra-low prices can carve out meaningful market shares big enough to succeed or if it will turn into another cautionary tale within the cutthroat world of global e-commerce.

For any consumer or competitor, this is very serious: keep your eyes on this space because the Temu Thai bet has the potential to alter the future of online retailing in Southeast Asia forever.